Summary: Retail supply chains are under pressure as sweeping tariffs and escalating trade uncertainty upend global sourcing strategies. Temporary fixes are falling short, forcing retailers to confront a structural shift that demands long-term resilience. This article explores how forward-thinking companies are shifting from legacy, cost-optimized models to adaptive, technology-driven supply chains to weather policy volatility, minimize disruptions, and gain a competitive edge.

Sweeping new tariffs and retaliatory trade barriers are shaking global retail supply chains1. Quick fixes—like rushing inventory or passing costs to consumers—are proving inadequate. Nearly 60% of CFOs expect heightened uncertainty, and most are already restructuring their supply networks2.

Retailers must recognize this is not a temporary disruption, but a structural shift requiring strategic supply chain adaptation.

Key Challenges in a Volatile Trade Environment

Retail supply chain leaders now face compounded risks:

- Unpredictable Cost Spikes: Rapid tariff hikes erode margins and destabilize pricing structures3.

- Policy Uncertainty: Geopolitical volatility undermines long-term sourcing and logistics strategies.

- Supply Disruptions: Reliance on limited sourcing geographies increases exposure to tariff shocks and sanctions.

- Complex Compliance: Managing new customs classifications and trade regulations demands greater operational diligence.

- Inventory and Cash Flow Pressures: Preemptive inventory strategies strain liquidity and increase obsolescence risks.

- Supplier Relationship Stress: Suppliers, too, are affected and may seek repricing, renegotiation, or market exits.

Legacy supply chain models, designed for cost-efficiency in stable environments, are insufficient for the current landscape.

Legacy supply chain models, designed for cost-efficiency in stable environments, are insufficient for the current landscape.

Why Adaptive, Resilient Supply Chains Are Essential

In a National Association of Manufacturers survey, 73% of respondents cited trade uncertainty as their top challenge4. As volatility increases, traditional cost-optimized supply chains are becoming liabilities. With tariff rates shifting rapidly, flexibility is as critical as efficiency.

Adaptive supply chains can quickly adjust suppliers, reroute shipments, and modify products to minimize disruption. Building resilience through backup options and flexible systems is essential to withstand shocks like tariff hikes or factory closures. Companies that proactively recalibrate sourcing, pricing, and logistics are outperforming those anchored to rigid legacy plans.

In short, building an adaptive supply chain is no longer optional—it’s essential for survival and growth.

Key Questions to Strengthen Supply Chain Strategy

To build more resilient supply chains, retail executives must ask critical questions that reveal vulnerabilities and opportunities:

- What does our sourcing network look like? How diversified is it, and where are we overly dependent on high-risk countries or suppliers? What percentage of our products comes from a single region, and do we have viable alternatives?

- Where are the bottlenecks? What choke points exist in our supply chain, and how vulnerable are they to disruption?

- What risks and contingencies have we identified? If a key supplier or product faces new tariffs or disruptions, do we have backup suppliers, alternative products, or tariff engineering options in place? How quickly can we shift procurement if needed?

- How agile is our decision-making? Do we have cross-functional teams (supply chain, finance, merchandising, legal) ready to respond to trade changes, or are our processes too slow and siloed?

- Are we effectively using technology and data? Can we monitor real-time tariff changes and supply chain conditions? Are we using scenario planning tools to model potential disruptions and responses?

- Can we adapt products or logistics to mitigate costs? Could design tweaks reduce tariff exposure, or could we leverage foreign trade zones, adjust shipping routes, or reposition inventory?

- How flexible are our supplier contracts and partnerships? Do agreements allow us to adjust order volumes, switch sources, or share cost increases with suppliers?

Sophisticated modeling—of supply networks, product structures (BOMs), external events, and dynamic conditions—is now essential to future-proof operations.

Evolving from Static to Dynamic Decision-Making

Traditional supply chain strategies built on static analysis are no longer sustainable. Annual reviews and fixed cost assumptions fail in a world where tariffs and trade conditions shift within weeks. A supplier deemed low-cost today could become a liability tomorrow.

Static approaches often leave companies reacting too late, eroding margins and market share. By contrast, dynamic decision-making—continuous monitoring, scenario planning, and rapid modeling—enables firms to anticipate disruptions and act preemptively. Leading retailers now equip cross-functional teams to quickly model trade impacts, adjust sourcing strategies, and protect profitability.

Dynamic supply chains, supported by live playbooks and scenario simulations, enable rapid, preemptive responses to external shocks. In a volatile environment, agility in supply chain decision-making is no longer a differentiator—it is a requirement for survival and growth.

In an era of constant trade volatility, companies must replace static supply chain strategies with dynamic, real-time decision-making to maintain resilience, profitability, and competitive advantage.

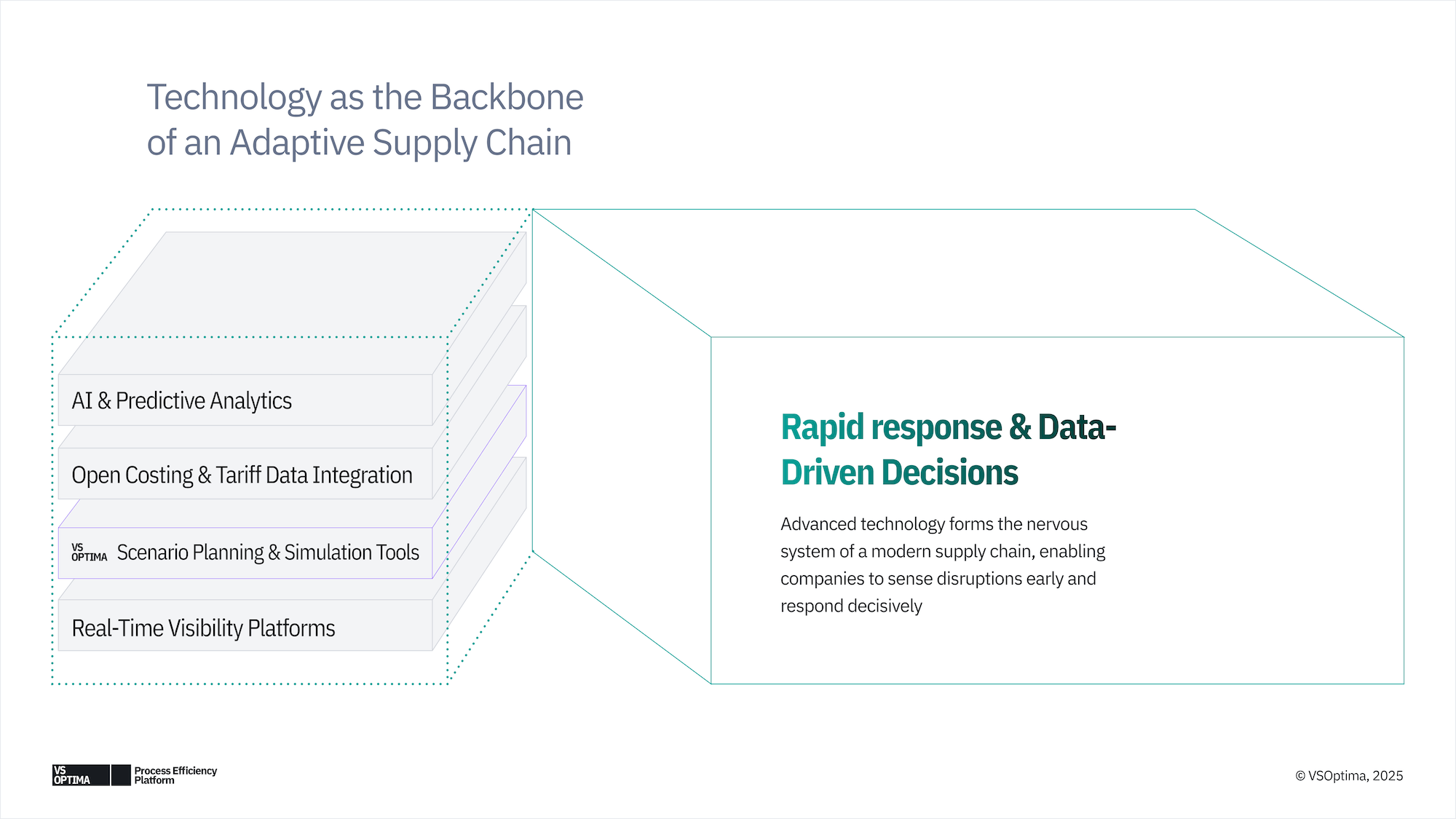

Technology as the Backbone of an Adaptive Supply Chain

Building an adaptive supply chain is impossible without real-time visibility and advanced analytics—and technology is the critical enabler. Several key solutions are helping retailers respond faster and smarter:

Real-Time Visibility Platforms: Cloud-based “control tower” systems offer end-to-end visibility across suppliers, shipments, and inventory. They allow companies to quickly pinpoint disruptions and activate backup suppliers, creating resilience at the system level.

Scenario Planning and Simulation Tools: Modern modeling and AI-driven digital twins enable teams to run “what-if” analyses on tariffs, costs, and lead times. This replaces static spreadsheets with rapid, evidence-based decision-making under uncertainty.

Open Costing and Tariff Data Integration: Open-costing tools integrate live freight, duty, and compliance data for a true landed-cost view, automatically updating as tariffs shift. This ensures leaders base decisions on accurate, current costs rather than outdated supplier quotes.

AI and Predictive Analytics: AI models synthesize vast data sets—from economic indicators to trade news—to flag risks and optimize sourcing and logistics strategies. These systems empower human planners with early warnings and intelligent recommendations.

In short, advanced technology forms the nervous system of a modern supply chain, enabling companies to sense disruptions early and respond decisively. Retailers who invest in these tools will build lasting agility, while those who lag risk being caught flat-footed by the next shock.

A Practical Blueprint for Supply Chain Resilience

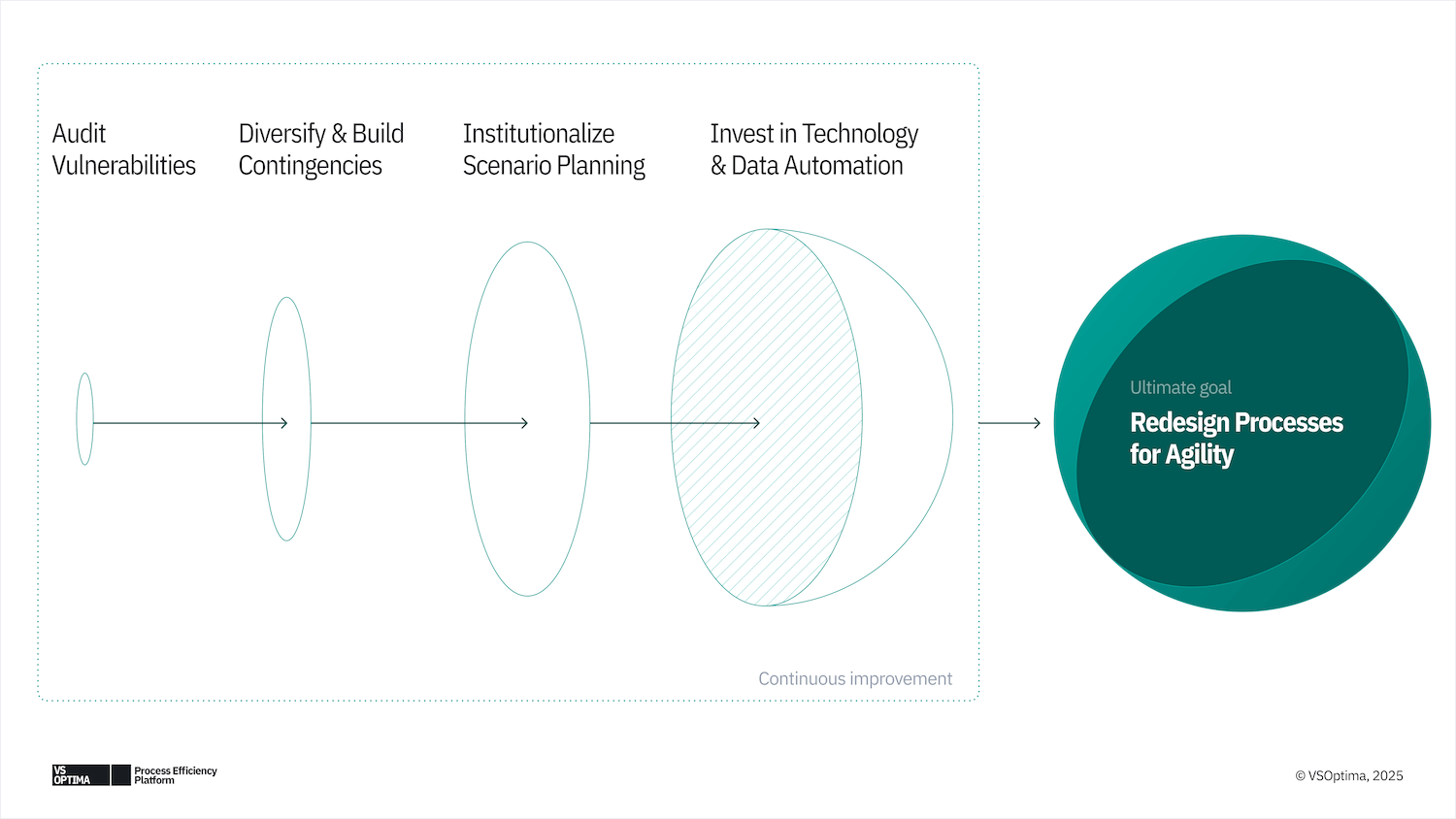

Recognizing the need for adaptiveness is only the first step; operationalizing it demands disciplined execution. Here’s a high-level blueprint to create a resilient, tariff-ready supply chain:

Audit Vulnerabilities: Start with a clear map of your supply chain, identifying tariff exposures and single points of failure. Quantify financial risks to prioritize where action is most urgent.

Diversify and Build Contingencies: Use audit insights to diversify sourcing across low-tariff regions, qualify backup suppliers, and negotiate flexible contracts. Expand geographic options for logistics as well, pre-negotiating agility before a disruption strikes.

Institutionalize Scenario Planning: Embed scenario modeling into regular operations. Establish a cross-functional trade response team, train teams on new tools, and run periodic war games to maintain readiness and reveal organizational gaps.

Invest in Technology and Data Automation: Implement visibility platforms, costing tools, and automated tariff alerts. Integrate trade data into your systems and prioritize quick wins through pilots rather than sprawling IT projects.

Redesign Processes for Agility: Streamline governance to empower rapid decisions. Update SOPs and incentivize resilience alongside cost savings. Foster deeper collaboration with suppliers to ensure readiness when the next disruption hits.

Building an adaptive supply chain isn’t a one-time project—it’s a continuous improvement cycle that, over time, becomes part of a company’s operating DNA.

In an era of constant trade volatility, companies must replace static supply chain strategies with dynamic, real-time decision-making to maintain resilience, profitability, and competitive advantage.

Conclusion: Agility Is the New Advantage

Tariff turbulence and trade uncertainty are the new normal. Instead of waiting for stability, retailers must embrace constant change as a catalyst for strengthening operations. The best-positioned companies are treating their supply chains as strategic assets—diversifying suppliers, embedding scenario planning, and empowering teams to make rapid, data-driven decisions.

Rather than merely mitigating tariffs, these leaders are turning uncertainty into opportunity, maintaining customer value and protecting profitability. For those still in reactive mode, the imperative is clear: evolve now. Delay increases exposure to margin erosion, stockouts, and lost competitive ground.

Building an adaptive, resilient supply chain must begin before the next disruption—not after. The retailers who act decisively today will not only survive turbulence but define the marketplace of tomorrow.

References

- “Amid Tariff Turmoil, Proactive Supply Chain Strategies for Retail”, Institute for Supply Management, April 21, 2025

- “Amazon and Walmart Overhaul Supply Chains as China Tariffs Bite”, PYMNTS, April 11, 2025

- “Global trade in 2025: Readying your company’s supply chain in a time of tariff wars”, Thomson Reuters, March 12, 2025

- “Enhancing supply chain resilience in a new era of policy”, Deloitte, April 1, 2025